IFPI data shows that music industry revenue has doubled to US$29.6 billion since 2014, with streaming now accounting for 69 per cent globally. Copyright remains key to navigating AI challenges, and the industry keeps investing heavily in marketing and artist development.

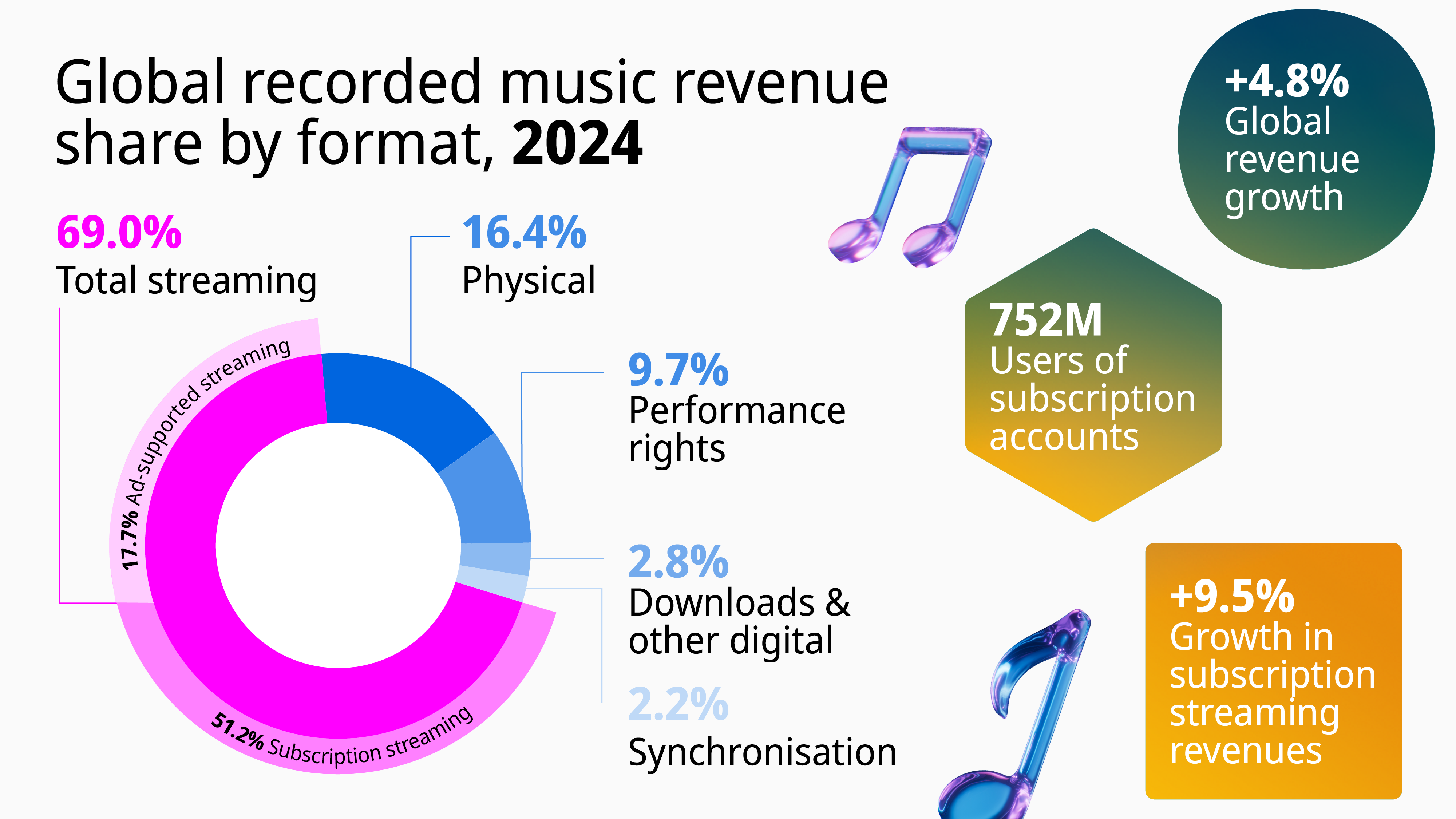

Data from the International Federation of the Phonographic Industry (IFPI) reveals that the value of the global recorded music industry has more than doubled since 2014, from US$14 billion to US$29.6 billion, with streaming now accounting for 69 per cent of revenue. The continued growth can be attributed to rights holders embracing innovation and licensing new music services, and to the unlocking of talent in the regions once hardest hit by piracy. Latin America, Sub-Saharan Africa, and the Middle East and North Africa are now the fastest growing markets for recorded music.

The latest data and trends show that the potential for continued growth remains, but IFPI emphasizes that respecting copyright frameworks and investing in artists remain essential. Artists and repertoire (A&R) and marketing spending reached an all-time high of US$ 8.1 billion already in 2023, amid unprecedented challenges to copyright from artificial intelligence (AI) companies.

From CDs to streaming: the revenue shift

In 2015, I wrote an article for WIPO Magazine on the state of the music industry, addressing the opportunities for and challenges to copyright and future growth. At that point, IFPI had just published data on global revenue for 2014 that showed the recorded music industry was worth US$14 billion, with compact disc (CD) sales the main source of income. Spotify had 15 million subscribers – there were 263 million in 2024 – and a major obstacle to growth was the market distortion caused by online content-sharing platforms distributing music without licenses while claiming to benefit from “safe harbor” privileges.

Ten years later, the 2025 IFPI Global Music Report provides the latest data. In 2024, the industry was worth US$29.6 billion, with 69 per cent of revenue coming from streaming. There were more than 750 million users of paid streaming subscription accounts globally, and, with the exception of a few holdouts, major content-sharing and social media platforms had negotiated licenses for music use. It is fair to say that the depth and pace of the industry’s transformation and growth have exceeded even the most optimistic predictions.

Three key factors driving global music industry growth

(1) Beyond streaming: physical products and performance licensing

While the market growth is mainly driven by paid streaming, physical products have not disappeared. On the contrary, sales of vinyl records have been growing steadily. Collective management organizations (CMOs) are also increasing revenue from broadcasting and public-performance licensing. So, although digital streaming accounts for most industry revenue, other products are also growing and contributing to the overall trend.

(2) Global expansion and local artist development

The industry growth is global and reaches all regions. The top 10 markets now include China, the Republic of Korea, Brazil and Mexico, and the fastest-growing regions in 2024 were the Middle East and North Africa, Latin America and Sub-Saharan Africa. Moreover, according to a recent paper on “Glocalization”, most countries in the study have seen “an absolute and relative increase in the domestic share of their top 10 songs and artists in 2022”. At IFPI, we see evidence of this trend in the annual top 10 charts for each market.

The data demonstrate the importance of investment in local talent to secure continued growth, and the importance of predictable and harmonized global copyright frameworks that support such investment. It cannot be overstated how important the WIPO Copyright Treaty and WIPO Performances and Phonograms Treaty are as the foundations of the global copyright system and enablers of the growth of local music and other creative industries.

(3) Equitable growth across the music value chain

All groups – songwriters, publishers, artists, record companies and distributors – in the music value chain have benefited. In the United Kingdom, the Intellectual Property Office (IPO) and the Competition and Markets Authority (CMA), in their respective studies on music creators’ earnings in the digital era, reported that artists and songwriters were receiving a larger share of the growing industry sales revenue, while the licensed streaming services provided consumers with unprecedented value.

IFPI has found the same trend globally. In 2023, record labels paid 34.8 per cent of their revenue to artists, with payments increasing by 107 per cent between 2016 and 2023. Songwriters and publishers have also benefited – their streaming revenue in 2023 was more than double what they earned from CD sales in 2001, the year when physical sales peaked.

US$8.1 billion in artist development: cutting through digital noise

It is also true that, while artists today have more choices and opportunities than before when it comes to producing and distributing their music, the “democratization” of music production and global competition make it harder than ever for artists to reach fans.

More than 100 million songs are available on streaming platforms, and more than 100,000 new recordings are uploaded daily, according to Luminate (the entertainment market monitor and insights provider that was once known as MRC Data and Nielsen Music). That is why record companies continue to play a key role in the music ecosystem; their expertise in finding, promoting and nurturing talent can help artists to succeed in the ever-intensifying fight for fans’ attention.

Further growth is not a given; it takes investment, belief in human artistry and a robust copyright framework.

What has remained constant during the industry’s rapid evolution and the significant changes in its operating environment are the centrality of artistry and record labels’ belief and investment in artists and their music.

According to the 2025 IFPI Global Music Report, labels’ investment in A&R and marketing reached an all-time high of US$ 8.1 billion in 2023. That investment is essential because investing in an artist is still high-risk, with only one or two out of 10 artists becoming commercially successful. That investment also benefits other players in the sector, from songwriters and publishers to digital service providers.

Against that backdrop, copyright protection remains a crucial precondition for record companies to make risky investments in artists and their music. Without the exclusive rights that copyright provides, labels would not be able to negotiate fair commercial terms for the use of their recordings necessary to secure the creation of new music and investment in new artists.

This fundamental tenet of copyright remains equally relevant in the context of generative AI.

There is no demonstrable consumer demand for AI-generated music; human artists are more than capable of satisfying the demand.

AI and music copyright

As governments around the world consider what, if any, adjustments to copyright frameworks are necessary for AI, it is important to learn from past mistakes – such as when online intermediary liability immunities were introduced – and not introduce exceptions without a thorough fact-based assessment of the societal need and economic impact.

There is no justification for generative AI providers to use sound recordings to train models without negotiating licenses. There is no demonstrable consumer demand for AI-generated music, human artists are more than capable of satisfying the demand for new music, and rights owners have demonstrated their ability to license rights at scale.

Legal battles over AI and music rights

Throughout the recording industry’s more than 100-year history, artists and record companies have embraced, constantly adapted to and collaborated with new technologies. AI is not an exception. Artists and their labels have been using different AI applications for years and will continue to do so.

The challenge for creative industries has not been the emergence of new technologies but the Pavlovian reflex of parts of the technology sector to call for the weakening of copyright (claiming that technological progress necessitates it) and the fact that new technologies are often used without respect for copyright rules, using “lack of clarity” as the pretext.

The growing number of legal actions by high-profile copyright holders against some of the largest generative AI providers, including OpenAI, Meta and Anthropic, or the music AI developers Suno and Udio, demonstrates the approach adopted by those companies.

This challenge to copyright policymakers is both unprecedented and familiar. It is unprecedented in that AI could well be the most powerful and transformative innovation in our lifetime. Yet, copyright based on robust exclusive rights has provided solutions before.

Balanced copyright policy in AI music

Three points stand out as touchstones for balanced copyright policy in the context of AI.

(i) The global copyright framework remains relevant

The global copyright framework based on the WIPO copyright treaties continues to provide a solid basis. Holders’ exclusive rights must be ensured and respected, and any exceptions or limitations must comply with the three-step tests enshrined in the treaties. There should be no exceptions, specifically, if licensing copyrighted works for AI training is a viable option.

(ii) Transparency is essential

Without sufficient transparency, exercising copyright becomes unreasonably difficult or prohibitively expensive. That is why, for instance, Article 53 of the recently adopted European Union Artificial Intelligence Act obliges AI developers to “draw up and make publicly available a sufficiently detailed summary about the content used for training of the general-purpose AI model…”.

(iii) Human creativity remains central

Copyright protects products of original human creativity. Creators across sectors use different AI tools to assist in creative processes. However, while artists’ use of AI tools should not disqualify the resulting works from protection, solely AI-generated outputs do not, and should not, enjoy protection under copyright laws.

AI can improve our daily lives and contribute to finding solutions to pressing issues, including developing new drugs and fighting climate change. However, it is important to distinguish between such societally beneficial objectives and the development of generative AI models that seek to freeride on human artistry. In the latter case, there is no basis for copyright exceptions; allowing AI developers to exploit rights holders’ creativity for commercial gain would be economically unsound and morally wrong.

The future of the music industry: streaming, copyright and AI

What do the next 10 years hold for the global recorded music industry? One of the most exciting things about our sector is that we simply don’t know what future musical trends, genres and artistry fans will embrace; there is always something new and unexpected.

What is clear, however, is that today’s recording industry embraces change and is directly engaged in driving innovation. This means continued growth in new and emerging markets, leading to greater artist development and opportunities to break out globally.

Technology will continue to be an essential partner as record companies explore ways to deepen the connections between artists and fans. As for AI, there is a positive way forward where music is licensed on fair terms to generative AI services based on principles of authorization and transparency. We need governments to recognize and support this.

Perhaps paradoxically, music’s exciting future is predicated on the same thing that has underpinned the past 10 years of its evolution: respect for the global copyright framework.